For purchases in excess of 1600 an additional state tax of 275 is added up to a. This amount is never to exceed 3600.

Tennessee Sales Tax Rates By City County 2022

The knoxville sales tax rate.

. 2 days agoAll three types of digital content provider cable satellite and streaming are required to pay sales taxes in Tennessee. The minimum combined 2022 sales tax rate for Knoxville Tennessee is. Tangible personal property taxable services amusements and digital products specifically.

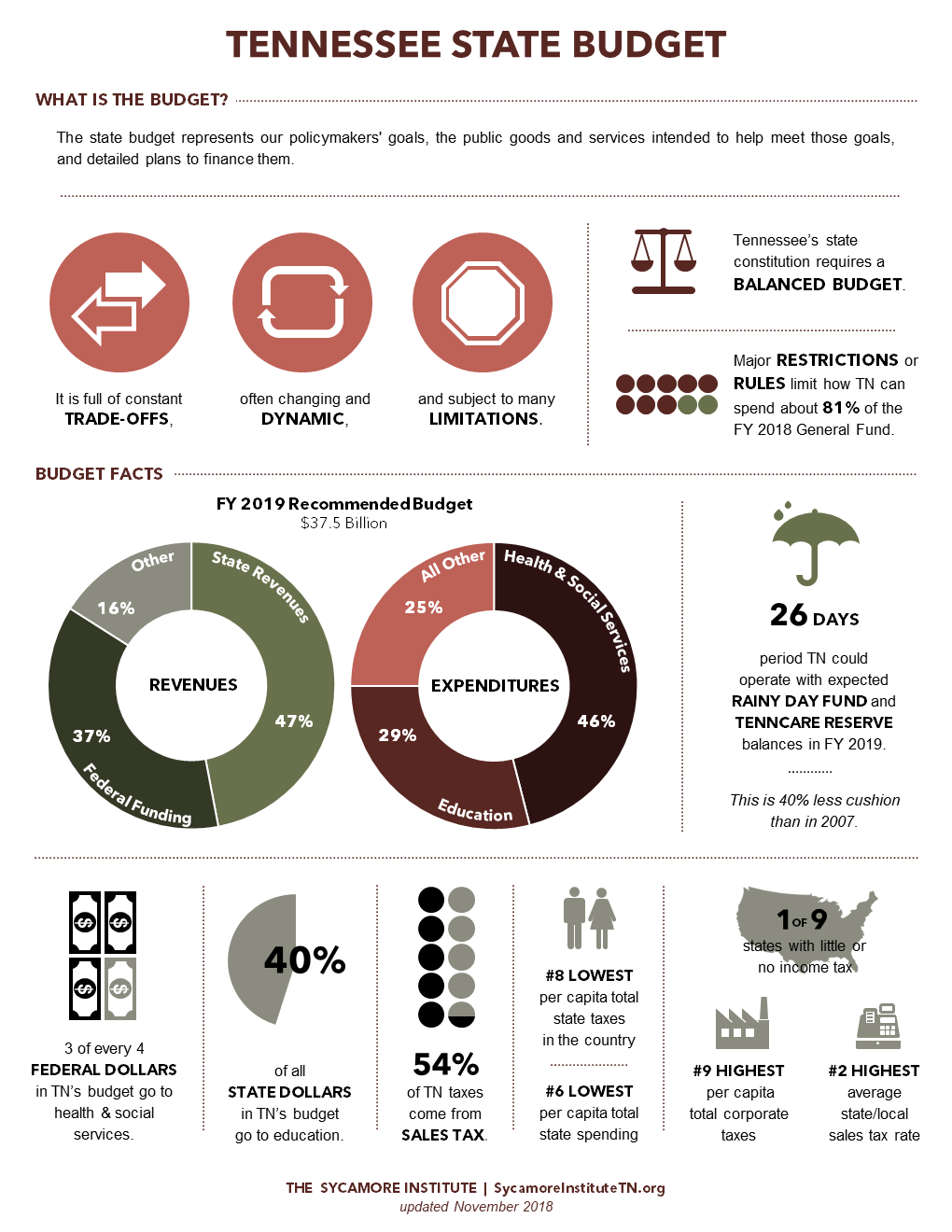

Under Tennessee sales and use tax law sales of motor vehicles trailers and off-highway vehicles are sales of tangible personal property subject to sales or use tax. Local Tax Rate Effective Date Situs FIPS Code County City Local Tax Rate Effective Date Situs FIPS Code Anderson 275. State Sales Tax is 7 of purchase price less total value of trade in.

4 rows Knoxville TN Sales Tax Rate The current total local sales tax rate in Knoxville TN is. 925 7 state 225 local City Property Tax Rate. Find your Tennessee combined state.

This is the total of state county and city sales tax rates. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. Knoxville filed its suit in December 2020 one year after the Tennessee Advisory Commission on Governmental Relations declined to recommend changes to the states cable.

3 rows The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and. Average Sales Tax With Local. Tennessee has state.

4 State Sales tax is 700. Current Sales Tax Rate. Local Sales Tax is 225 of the first 1600.

Local tax rates in Tennessee range from 0 to 3 making the sales tax range in Tennessee 7 to 10. County Property Tax Rate. Sales Tax and Use Tax Rate of Zip Code 37922 is located in Knoxville City Loudon County Tennessee State.

A bill to help pay for a 65 million multi-use stadium in downtown Knoxville is heading to the governors desk after it was passed in the Tennessee. The base state sales tax rate in Tennessee is 7. There are some exceptions.

24638 per 100 assessed value. 212 per 100 assessed value. Sales Tax and Use Tax Rate of Zip Code 37932 is located in Knoxville City Knox County.

Purchases in excess of 1600 an. Hi im a little confussed. The knoxville tennessee general sales tax rate is 7.

31 rows Kingsport TN Sales Tax Rate. Knoxville TN Sales Tax Rate. Addition there is a state single article tax rate of 275 which is discussed later in this text.

In fiscal year 2017-18 total sales tax revenue from. Counties and cities can charge an additional local sales tax of up to 275 for a. The Clerk and Master will open the bidding process with the total due on the property for delinquent taxes through the 2012 tax year interest penalty fees and other cost associated.

The Tennessee sales tax rate is currently.

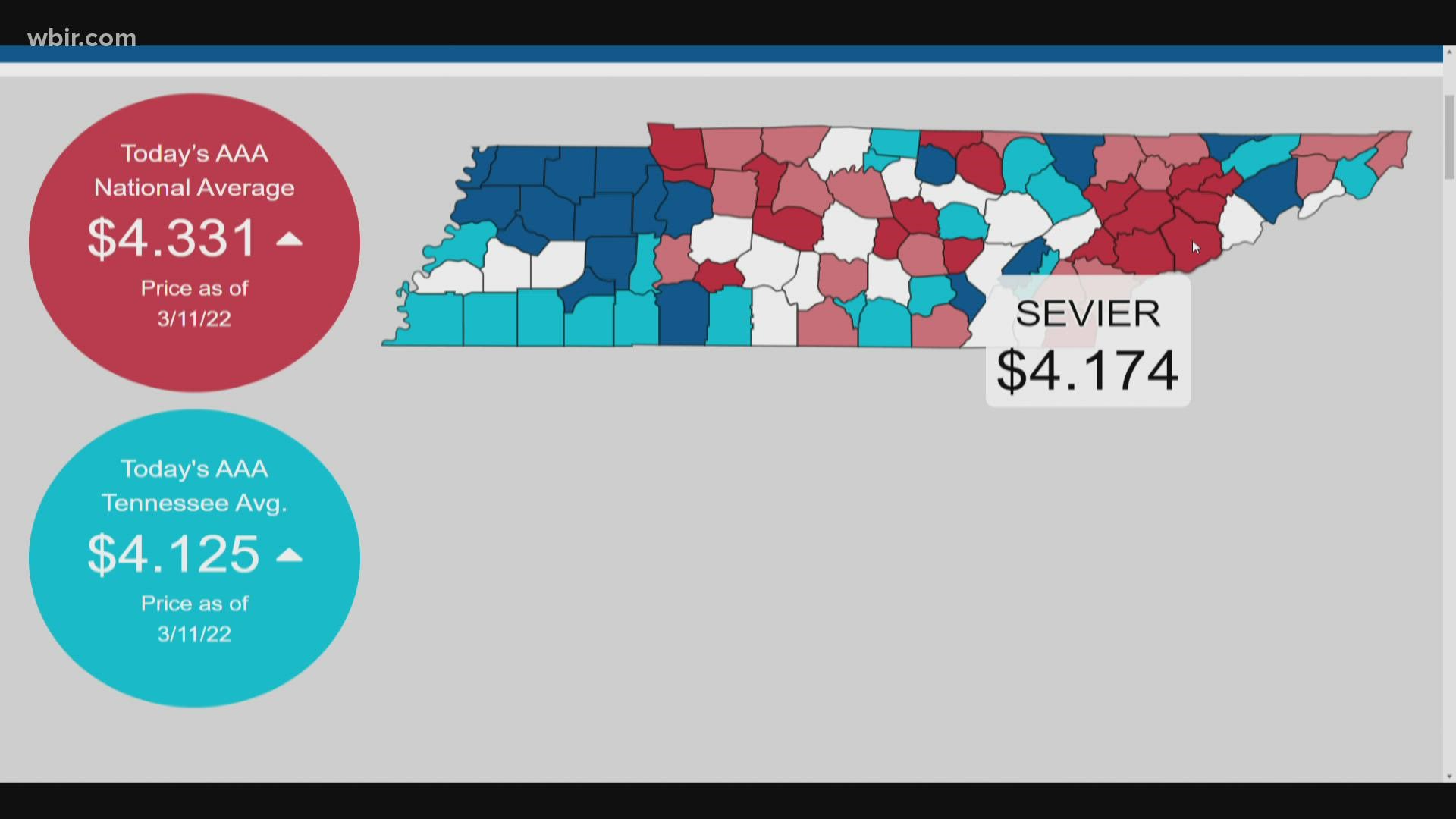

Gov Lee Has No Plans To Halt Tn S Gas Tax Amid Price Surge Wbir Com

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Sales Tax Small Business Guide Truic

Tennessee Sales Tax And Other Fees Motor Vehicle County Clerk Knox County Tennessee Government

Llc Tennessee How To Start An Llc In Tennessee Truic

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Globaledge Your Source For Global Business Knowledge

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Georgia Sales Tax Rates By City County 2022

Tn 6th Most Regressive Tax System In Us R Nashville

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Car Sales Tax Everything You Need To Know

Historical Tennessee Tax Policy Information Ballotpedia

Tennessee Income Tax Calculator Smartasset